|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

First Time Home Buyer Programs NY: A Comprehensive GuideBuying your first home in New York can be both exciting and overwhelming. Fortunately, there are several programs designed to help first-time home buyers navigate the process with ease. This guide explores the various options available and highlights key features to consider. Understanding New York's First-Time Home Buyer ProgramsNew York offers a range of programs tailored to assist first-time buyers. These initiatives often provide financial assistance, education, and support throughout the home buying journey. State of New York Mortgage Agency (SONYMA)The State of New York Mortgage Agency (SONYMA) offers affordable mortgage options for first-time buyers. With competitive interest rates and down payment assistance, this program is a popular choice for many.

Federal Programs Supporting New York Home BuyersIn addition to state programs, federal initiatives can also be beneficial. Exploring options like the fha refinance after foreclosure program may provide additional support. Eligibility RequirementsTo qualify for these programs, understanding the eligibility criteria is crucial. Generally, applicants must be first-time buyers, but there are other factors to consider as well. Income LimitsMany programs have income limits to ensure they assist those who need it most. Checking these limits is an important step in the application process.

Credit Score ConsiderationsCredit scores play a vital role in determining eligibility. While some programs have flexible requirements, maintaining a good credit score can enhance your options. Steps to ApplyApplying for these programs involves several steps, from gathering documentation to completing applications. Documentation Required

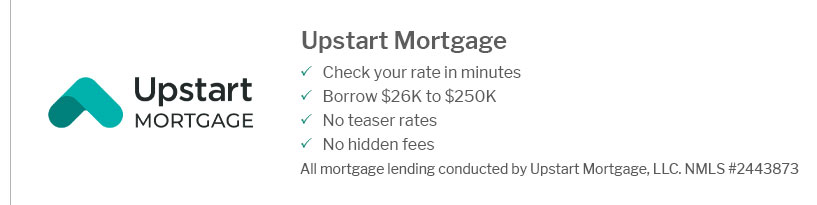

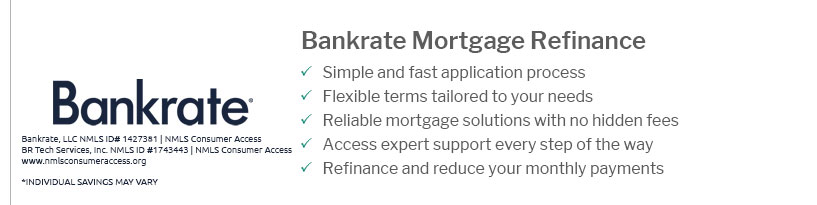

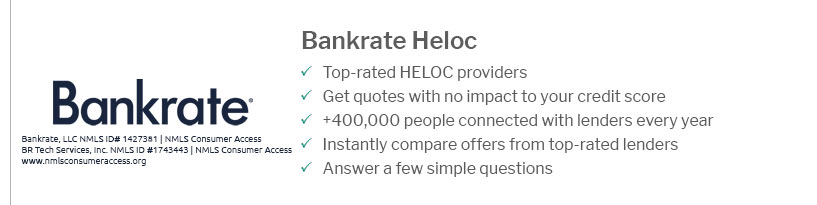

Having these documents ready can streamline the application process. Working with LendersChoosing the right lender is crucial. Understanding their requirements and how they align with programs like fha streamline refinance cash out can be beneficial. FAQsWhat qualifies as a first-time home buyer in New York?In New York, a first-time home buyer is typically defined as someone who has not owned a home in the past three years. This definition allows many to qualify for assistance programs. Are there any tax benefits for first-time home buyers?Yes, first-time home buyers in New York may be eligible for various tax credits and deductions, such as the Mortgage Credit Certificate (MCC) program, which can offer significant tax relief. How can I improve my chances of getting approved?Improving your credit score, reducing debt, and having a stable income can enhance your chances. Additionally, participating in homebuyer education programs can be beneficial. https://www.nyc.gov/site/hpd/services-and-information/homefirst-down-payment-assistance-program.page

The HomeFirst Down Payment Assistance Program provides qualified first-time homebuyers with up to $100,000 toward the down payment or closing costs on a 1-4 ... https://hcr.ny.gov/homebuyers

The HCR Housing Choice Voucher (HCV) Homeownership Program helps first time homebuyers obtain and retain a home of ... https://hcr.ny.gov/sonyma

State of New York Mortgage Agency (SONYMA) offers low-interest mortgage loans and programs to help qualified buyers purchase their first home.

|

|---|